Mirror World

Investing During The Apocalypse

By Guy Crittenden

The most spiritual thing a person can do at this time is buy Bitcoin.

I actually said that to a friend recently at a meeting of a weekly local investment club I facilitate. It’s one of several prepper committees I’m on that meet regularly to discuss everything from the best walkie-talkies for purchase to how to grow food.

The rationale for my statement relates to Bitcoin’s utility in World War Four, in which the forces of centralization and decentralization are competing for global domination.

Don’t lose touch with uncensored news! Join our mailing list today.

If that sounds like the premise of a B movie, well, that’s the world we’re in now.

It’s said the globalists originally planned to impose their New World Order (NWO) several decades from now, but something caused them to move the date forward. “Why” remains a mystery, since the technologies of the so-called Fourth Industrial Revolution (4IR) and transhumanism would have been more developed, and the walls of our impending digital prison could have been built much higher.

I think the globalists saw Satoshi’s Bitcoin cryptocurrency project explode and threaten their plans with the real possibility of people’s liberation from central banks, authoritarian government, and the perpetual war model under which we’ve lived ever since gentlemen adventurers formed companies to exploit Hudson’s Bay and East India.

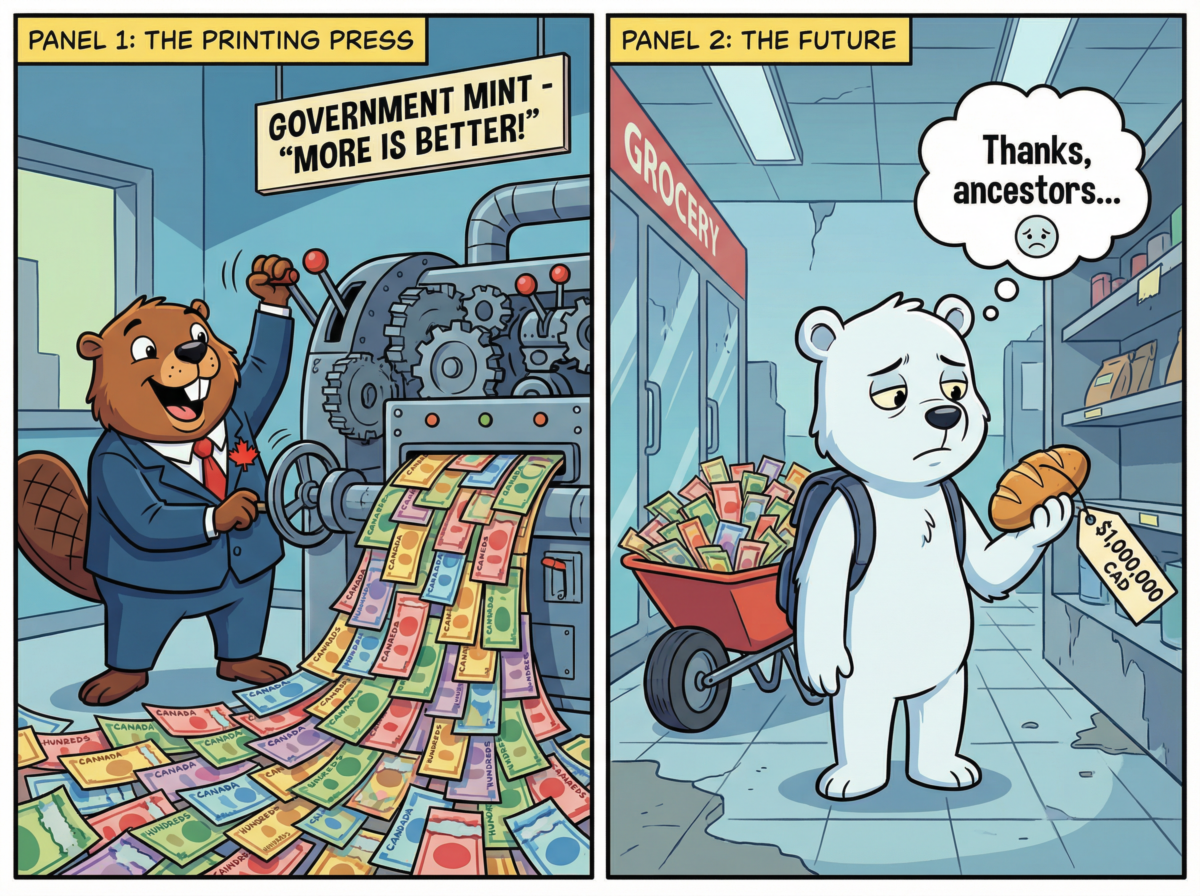

Ever since the US uncoupled the greenback from gold, and Henry Kissinger negotiated the creation of the petrodollar with the House of Saud, the eventual collapse of fiat currency was baked into the world’s reserve currency. All fiat currencies eventually veer to zero, and our financial system essentially died in 2008 with the mortgage fraud crisis. The system has been on life support ever since, with the US Federal Reserve (a private banking cartel) keeping the casino-economy afloat by inflating; that is to say, printing money. And here we are a dozen years later, with the system finally on the brink of collapse. The government is in a predicament, a debt squeeze, from which there is actually no escape. The Fed has only two tools at its disposal: it can print more money (inflate) or raise interest rates. The latter would crash (what’s left of) the economy so they’re going with inflation, ergo the rise in commodity prices.

Many investors think the government and the central banks are operating from a place of goodwill. They are not. All they’re doing is keeping the game going until the signal is given to the hedge fund managers to short the stock market and crash the economy which will deliver the coup de grace of the totalitarian takeover.

Note that many Wall Street execs recently quit their positions. The (planned) biological crisis provided a fig leaf for the deliberate evisceration of the middle class on all continents. Many of the virtual signallers swiping their QR codes to access restaurants and concerts will have that smug look wiped permanently from their faces when the value of their homes and pensions vanish like rain on Georgia asphalt.

I watch investment programs on YouTube and other platforms every day, and have noticed a fascinating shift. A year ago when I was sounding the alarm about all this, most of the informed commentary resided on alternative platforms such as BitChute. Today, many mainstream investment program hosts talk openly about the globalist plot in ways previous unthinkable. They speak in code when referring to “the virus” so their channels aren’t demonetized or deleted, and use words like “plandemic” and “totalitarian.” I almost choked on my chips and salsa when Lynette Zang (the grandmotherly host of ITM Investment’s YouTube program on previous metals investing) advised viewers to find a location to make their “final stand.” (Zang owns a remote mountain cabin with a permaculture garden.)

Market commentators like Zang understood the World Economic Forum’s commercial, “You’ll own nothing. And you’ll be happy,” perfectly well. They know commodity prices aren’t soaring because things like oil, steel and oats are becoming more valuable, but because the purchasing power of currency is crashing. Some advocate dividing savings into tranches of real estate, precious metals, crypto, and stocks & bonds.

Regarding stocks and mutual funds, the era of “set it and forget it” retirement savings plans is over. With inflation running hot, the old conservative model is now the most risky, and informed investors are being drawn into speculative asset classes as a matter for survival. Imagine a world without money! Some sort of barter economy will emerge after the presumed collapse; gold and silver and crypto will potentially do a moonshot, but even if they don’t, people will seek them because eventually we’ll cease comparing their value to dollars and think only in terms of what they might obtain: say, six hard-to-find oranges or a stale loaf of bread.

I learned of Adam Fergusson’s book When Money Dies: The Nightmare of the Weimar Collapse from an episode of George Gammon’s investment program on YouTube. It’s a real page-turner, given what’s underway. I’m not sure anything can save us if there’s a total Mad Max-level societal breakdown, but at least my wife and I are semi-prepared. In addition to stocking the pantry with several months worth of food, and buying precious metals, the most interesting research has been in the dynamic world of crypto, about which I have mixed feelings.

None of this is investment advice, of course, but our biggest position is in Bitcoin (BTC) and Etherium (ETH) and I do subscribe to some of Bitcoin maximalist Michael Saylor’s perspective, recently bolstered by a superb video from Australian Max Wright (“Contrarian Dude” on YouTube) entitled “David Morgan and the War over Your Freedoms” (December 14, 2021): that BTC is real money and will likely rise in value into the hundreds of thousands.

I also enjoy the perspective of former hedge fund manager and macro analyst Raoul Pal (Real Vision) and what he calls the “exponential age” — his term for Moore’s Law of exponential technological growth and Metcalfe’s Law (the network effect), that will do for crypto what they did for the internet and companies like Google, Amazon and Facebook.

Of course, every idea in these Apocalyptic times comes with risks, especially since everything (except maybe crypto) is in a bubble. Real estate is a conservative investment, but prices in many places are in nosebleed territory. (Yet, one has to live somewhere…) As I write this, the stock market is showing signs of topping, and when it crashes (according to pessimist Harry Dent) it’ll bring down crypto and metals too (for a while), though the latter items should recover quickly. Storing gold and silver is a huge pain in the ass, but then so is the thought of losing one’s crypto keys or seed phrases.

Argh! Nothing about this is simple or easy. But we must “adult” about this as the banks could collapse and the laws have been changed to allow “bail ins” — the term for when the bank steals your money and offers (potentially worthless) bank stock in its stead. Any funds above $100,000 are at risk, and even CDIC-insured cash may not be safe, given that reserve fractional banking allows institutions to lend out at 10-to-1 (or higher) against deposits.

Many investors are diversifying away from BTC and ETH into so-called alt coins (e.g., Solana, Terra, Polkadot, etc.) because they could deliver outsized returns. Even if the globalists crash the economy and take down the internet (for a period of time), their plan involves people staying at home, plugged into a dystopian metaverse where they can buy virtual real estate and engage in “play to earn” games in the tokenized economy that Philadelphia researcher Alison McDowell warns of. I’m opposed to these sinister Matrix-like schemes, but I relish the opportunity to make a few bucks in the short-term so I can resist for longer. I’ve committed to studying the metaverse and the virtual reality technologies to see if they can be harnessed for good. I recently invested in Decentraland for that reason, the idea being that it’s a decentralized artificial world, unlike the (very uncool) centralized one Facebook (Meta) recently announced.

Had the public risen up and stopped complying, this struggle could have ended long ago. While I believe the biological narrative is falling apart, ultimate victory over (and recovery from) the globalist attack is likely years away. Next will come resistance to climate lockdowns, and the impending AI control grid and social credit system with all its satellites, 5G towers, and facial recognition cameras. In addition to growing food and avoiding incarceration in “quarantine camps” we need to render unto Ceasar what is Caesar’s until the new economic system matures, on our terms and not that of the Rockefeller’s and the Rothschild’s.

In the end, the truth will set us free. But a bit of Bitcoin and Etherium might help too.

Guy Crittenden is a freelance writer and author of the award-winning book The Year of Drinking Magic: Twelve Ceremonies with the Vine of Souls (Apocryphile Press, San Francisco). Follow Guy at HipGnosis.co