“You Will Own Nothing”, So They Say

By Paul Grignon

“The issue which has swept down the centuries and which will have to be fought sooner or later is the people versus the banks.” Lord Acton 1834-1902

“Whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower’s bank account, thereby creating new money.” Money Creation in the Modern Economy (2014)

The above ‘banker’s privilege’, recently admitted to by the Bank of England and subsequently affirmed by the Riksbank (Sweden’s central bank) and the Swiss National bank is all that is needed to correctly understand what money is in the current system — principal debt to a bank. Central bank reserves are principal debt to the central bank. “Money” is principal debt to a commercial bank. See my previous article The Crucial Need to be Free of Monetary Misconceptions (Druthers, July 2022)

Don’t lose touch with uncensored news! Join our mailing list today.

Bankers’ Magic

Most money is created as mortgages. When what we commonly refer to as ‘the borrower’ signs the loan document, promising to pay the bank let’s say one million dollars plus interest over time, the bank promises the borrower one million dollars by typing that number into the borrower’s chequing account. In this way, one million dollars of spendable new bank credit has been created. The bank has converted the borrower’s promise (liability) that the public would not accept as money into the bank’s promise (liability) that the public does accept as money. This process creates about 97% of the money supply in most developed nations.

The borrower buys the house and the borrower’s bank now owes the seller’s bank one million dollars in central bank reserves. Central bank reserves are credit for printed cash on demand. Central bank reserves are the real money of the system in that banks have to pay each other with central bank reserves which they are unable to create. Central bank reserves are created as someone’s promise, normally the national taxpayer, to pay the central bank. Only the interest is paid (by the taxpayer), which keeps the reserves and cash in existence. The interest pays for the operations of the central bank, with any excess returned to the national government. Cash and reserves are usually just a tiny fraction of the total money in existence, typically 3% in developed nations.

It should be noted that since the 2008 Crisis, central banks have been buying other forms of debt besides government bonds, calling it “quantitative easing”. It should also be noted that the ‘fractional reserve system’ which supposedly limits commercial banks to a regulated multiple of a fixed amount of central bank reserves is just a monetary myth. The truth is the opposite — new reserves are created by the central bank in response to an increase in the volume of commercial bank lending. The following excerpts should set the record straight.

From Money Creation in the Modern Economy:

… “neither are reserves a binding constraint on lending, nor does the central bank fix the amount of reserves that are available, the relationship between reserves and loans typically operates in the reverse way to that described in some economics textbooks. Banks first decide how much to lend depending on the profitable lending opportunities available to them… It is these lending decisions that determine how many bank deposits are created by the banking system … The amount of bank deposits in turn influences how much central bank money banks want to hold in reserve … Rather than controlling the quantity of reserves, central banks today typically implement monetary policy by setting the price of reserves — that is, interest rates.”

Now let’s return to the million dollars in central bank reserves our borrower’s bank owes the seller’s bank after the borrower’s cheque is deposited at the seller’s bank. How can 3% reserves be enough to settle these transactions of the 97%? Quite easily.

If the seller’s bank is the same as the borrower’s bank, the million dollar liability of the borrower’s bank is to itself! The million dollars of bank liabilities just moved from one account to the other. Zero central bank reserves required.

If the million dollar cheque is deposited at a different bank, then the borrower’s bank does owe the seller’s bank a million dollars in central bank reserves. But, mathematically, the banking system acts as one bank because all of the banks are doing the same thing. The borrower’s bank needs only to receive a million dollars in the liabilities of other banks and the result will also be a net payment of zero.

The real world process is infinitely more complicated, but through the clearing system, most interbank debts cancel each other out. Banks that come up short on deposits pay interest to banks that have excess deposits at the “interbank rate”. This interest rate on interbank debt of reserves reduces any profit from making loans in excess of deposits, and thus disciplines banks to remain within their deposit base.

o recap: while banks do not lend depositors’ money, as people have long and wrongly assumed, banks still need a dollar deposit to make a dollar loan. The order is just reversed. First create new money. Then get the equivalent back as a deposit. As long as a bank receives deposits equal to or greater than withdrawals, it can create as much money as borrowers are willing to borrow.

Mathematically Inevitable Default

As a liability on a bank’s balance sheet, bank credit money ceases to exist when a principal payment is made to a bank.

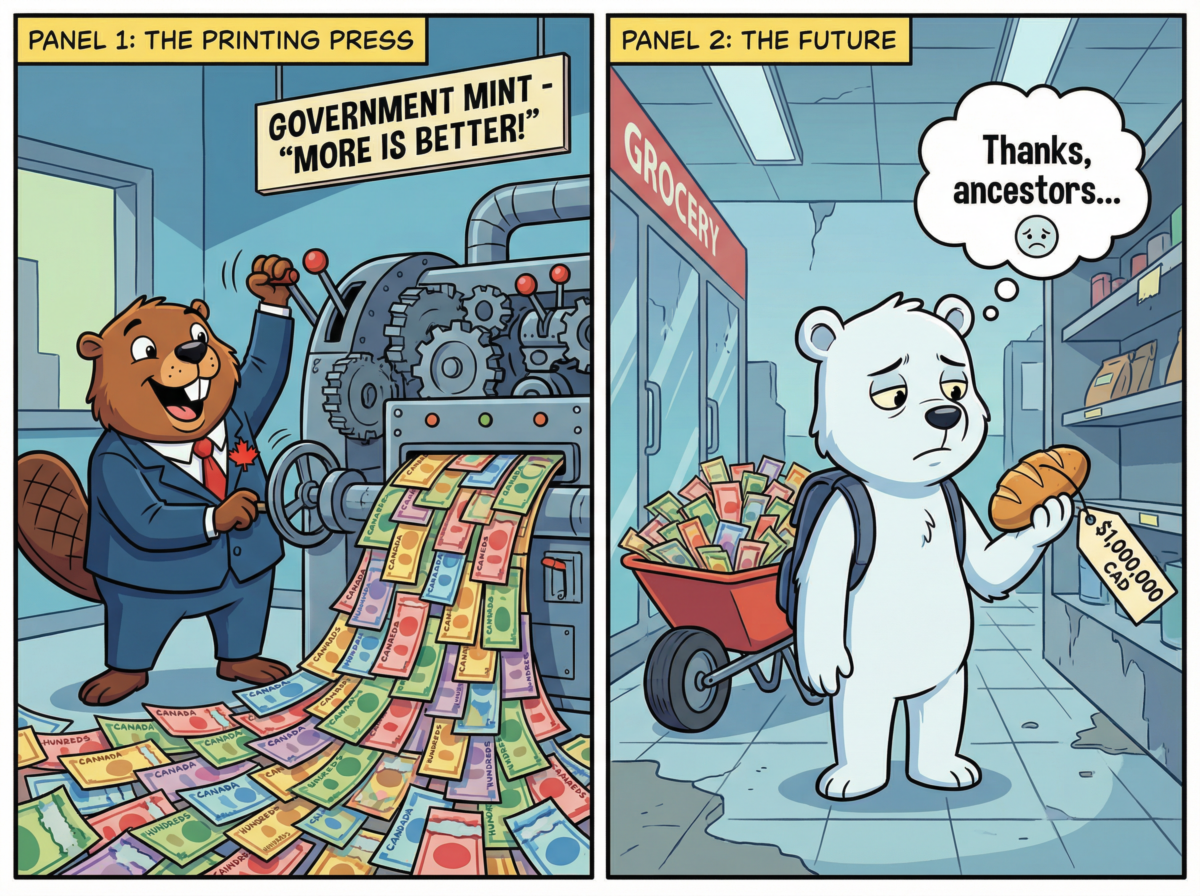

In the current situation, the central bank seeks to reduce the inflation caused by the bank’s previous low interest rates and excessive money supply expansion. Interest rates are, therefore, being increased. The intention is to discourage new money creation. But the stability of the system depends on money creation never slowing down. See my previous article — The Crucial Need to be Free of Monetary Misconceptions (Druthers, July 2022)

If new money creation fails to keep pace with, or exceeds the amount of money repaid as principal debt and is extinguished, the inevitable result is a shrinkage in the amount of money in existence. Unless the shortage is made up by someone creating new debt, to fight a war for example, this has to mathematically cause certain defaults. People will lose their homes to the banks as in 2008. The banks can then sell them to investment companies.

Where will the investment companies get the money? They can borrow it into existence from the banks, thus rectifying the money shortage (“you will be happy”) and pay perpetual interest on that debt by renting to us what we used to own.

Here’s the Punch Line

Now it is time to note that banks can also buy real estate, stocks or any other saleable asset by creating new ‘money’ the same way they do for loans and bonds. The property goes on the asset side of the balance sheet. If they all do it, the liabilities they create will all come back to them. In this way, it doesn’t cost the banking system anything to buy up real property or to create new money for big corporate investors to do the same.

While I don’t know their plans, especially at what stage central banks may enter commercial banking with their central bank digital currencies, I would assume “You will own nothing” (and be happy about it, according to Klaus Schwab and The World Economic Forum of Globalists) must have a method behind it. The banker’s privilege, central or commercial, is all the banks ever needed to buy up everything either for themselves or favoured investors. This looks like that moment in history predicted by Lord Acton — when the banking system will manage to steal the whole world if we are confused and helpless about how they are doing it.

Default crises are an inherent part of banking system design. As such, they are an injustice against us that we have a right to resist.

I have much more money system analysis and solutions at moneyasdebt.net.

See my sub-chapter on Mortgages for a quick glimpse into a completely different world.

http://paulgrignon.netfirms.com/MoneyasDebt/ MAD2014/solution7mortgages.htm

Paul Grignon is an artist and videographer, and the creator of the Money as Debt Trilogy.